The smart Trick of Paul B Insurance That Nobody is Discussing

Obtaining medical insurance in the US is not a very easy thing. A person may believe that as soon as you have cash every little thing is easy peasy, however in reality things are a bit extra challenging. One have to be very cautious and also keep an eye out to select the right insurance coverage. The USA federal government does not offer medical insurance for all its people, as well as wellness insurance policy is not required for those residing in the United States.

There are 2 kinds of health and wellness insurance coverages in the US, exclusive as well as public. The United States public health and wellness insurance policies are: Medicare, Medicaid, as well as Kid's Health Insurance coverage Program.

More About Paul B Insurance

It supplies medical insurance for United States nationals older than 65 years old, yet also for more youthful people with end phase renal disease, ALS, as well as some other disabilities. Information shows that in 2018, Medicare provided practically 60 million people with healthcare in the US, over 51 million of which were older than 65.

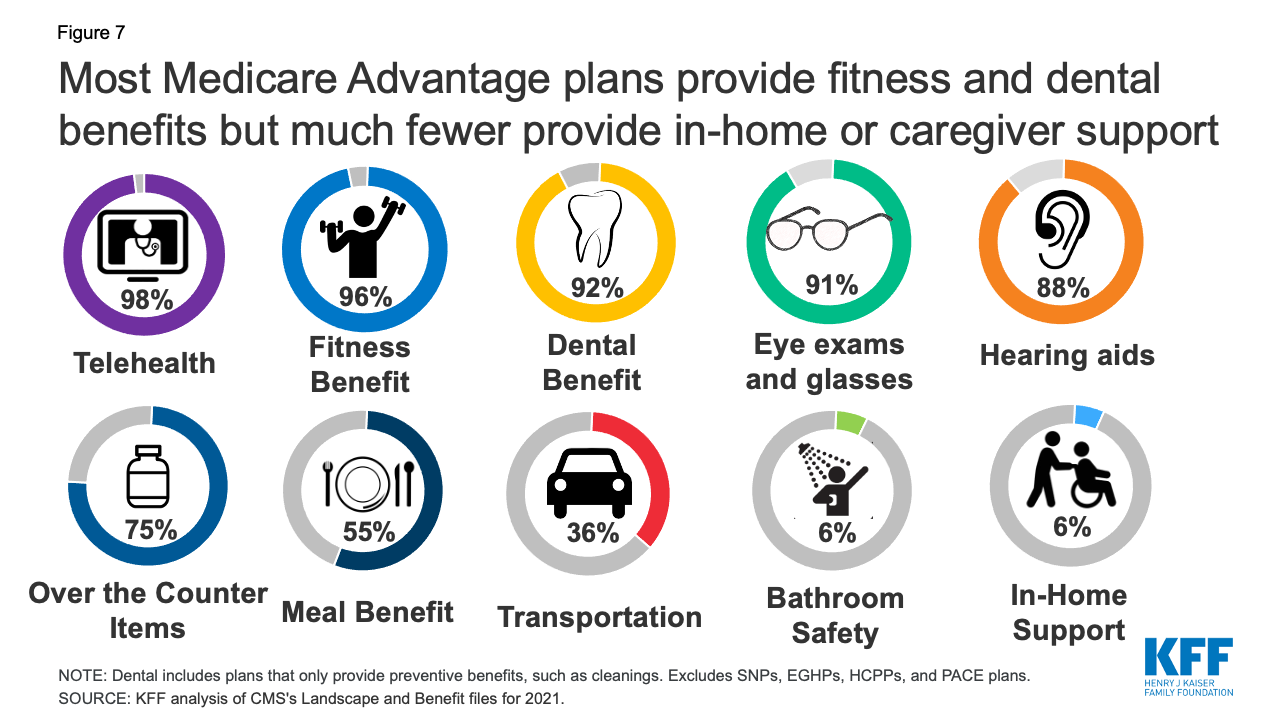

covers outpatient solutions, including some providers' services while inpatient at a healthcare facility, outpatient health center charges is an alternative called Managed Medicare, which permits patients to choose health insurance plan with at least the same service protection as Component An as well as B, typically the advantages of Component D, as well as a yearly expense invest limit which An and also B lack.

covers mainly self-administered prescription medicines. Medicaid is a federal as well as state program that aids individuals with minimal income as well as resources to cover clinical costs, while covering advantages normally not covered by Medicare, as nursing house treatment and also individual treatment solutions. It is the biggest resource of funding for medical and also health-related services for people with low earnings in the United States.

Indicators on Paul B Insurance You Should Know

Formerly called the State Kid's Health Insurance coverage Program (SCHIP), this is a program that covers with medical insurance children of family members with small revenue, that are not reduced enough to qualify for Medicaid. The Person Defense and also Affordable Treatment Act is a federal law authorized into law by Head of state Obama, that made it mandatory for every single person to have health insurance or be penalized.

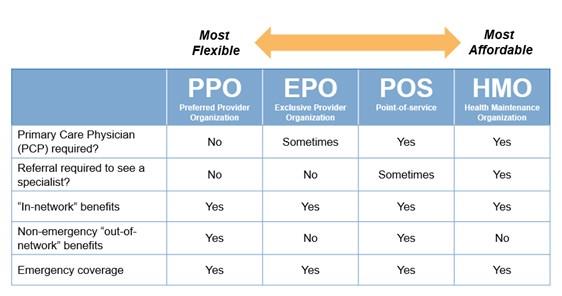

Typically, there are 3 kinds of medical insurance in the USA: which plans are typically one of the most expensive, that those with an earnings reduced than the typical earnings in the US, have troubles to purchase. However, these are the learn the facts here now best plans as they provide you most flexibility. which supplies a restricted option of health care carriers, yet it additionally uses lower co-payments and covers the costs of even more preventative treatment.

The Ultimate Guide To Paul B Insurance

The United States Authorities have not made health and wellness insurance compulsory for temporary travelers to the nation, as B-1/ B-2 visa owners, it is extremely advised for every tourist to obtain insurance policy prior to their trip to the nation. The primary reason why you need to obtain insurance policy is that medical care in the US is exceptionally pricey as well as even an exam for an easy frustration will certainly cost you numerous dollars, while a broken arm or leg will certainly cost you thousands.

The majority of the moment, "certified non-citizens" are eligible for protection with Medicaid and Children's Health and wellness Insurance Program (CHIP), considered visit their website that they meet the earnings and also residency rules of the state where they are based. "Certified non-citizens" are taken into consideration the following: Lawful irreversible locals Asylees, refugees, damaged non-citizens & partners, children, or moms and dads, sufferers of trafficking and also his or her partner, kid, sibling, or moms and dad or individuals with a pending application for a target of trafficking visa Cuban/Haitian participants, Those paroled right into the United States for at the very least one year Conditional participant approved before 1980 those provided withholding of deportation and also participants of a government recognized Indian Tribe or American Indian born in Canada.

The Greatest Guide To Paul B Insurance

Medicare health and wellness strategies give Component A (Healthcare Facility Insurance Policy) and also Component B (Medical Insurance) advantages to people with Medicare. These plans are usually used by personal companies that contract with Medicare. They include Medicare Advantage Plans (Component C) , Medicare Expense Strategies , Presentations / Pilots, and Program of Extensive Look After the Elderly (RATE) .

You ought to have the ability to view your network of service providers on your insurer's participant site or in a network provider directory. You can likewise call the customer support line and talk to an agent. To assess your costs, check out your existing insurance plan or see your insurance provider's member website.